Further, you can save the invoices or share with the businesses or customers in real-time. You can even automatically send invoices to the customers regarding their overdue payments.

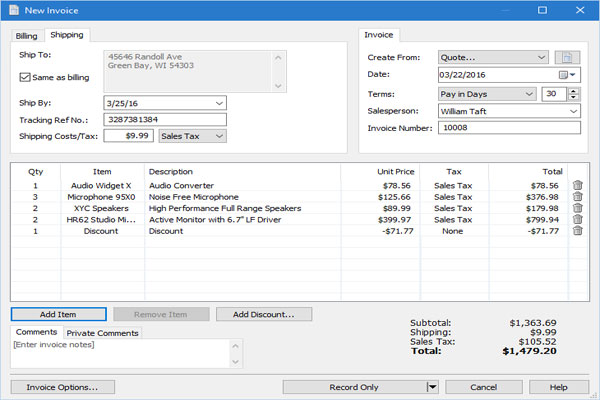

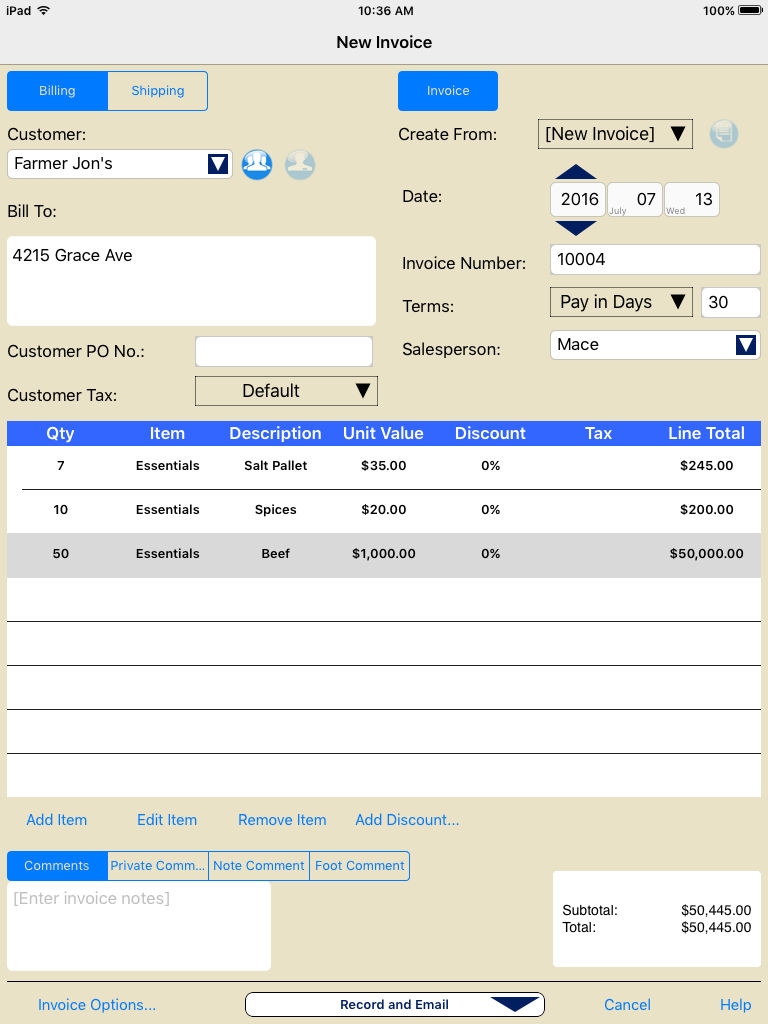

As a business owner, you can also customize your invoices by using your business logo, customized notes, heading text and more. There are multiple pre-loaded invoice templates as well that can help create invoices easily. NCH Express Invoice quickly creates quotes, orders, and invoices. How the Invoicing Features of NCH Express Invoice help a Business? Further, it also monitors sales team performance, checks the overdue accounts and more. The inbuilt reporting component assists you in keeping track of payments.

#Nch express invoice id key software

To make faster payments, this invoice software helps generate invoices within a few clicks and allows you to email, print or fax the clients directly. NCH Express Invoice is a smooth and user-friendly invoicing software that enables users to operate and keep a track of billings. NCH Express Invoice Software Overview What is an NCH Express Invoice?

Users should make sure the information they enter is accurate.Īny request for a correction to the GST Invoice will not be entertained by or the Seller. Please be aware that the GST invoice must include the user's GSTIN and the name of the business entity that the user has specified. if an exchange offer is made concurrently with the purchase of the goods

if the items come with Value Added Services such as Complete Mobile Protection or Assured Buyback. The following goods and services will not be eligible for GST Invoice: Only specific items sold by participating sellers and bearing the callout "GST Invoice Available" on the Platform's product detail page will be qualified for GST Invoice. Please be aware that not every product qualifies for a GST Invoice. The User's specified Entity Name for the User's Registered Business The GSTIN submitted by the User in connection with the registered business of the User. The user will be sent a Tax Invoice ("GST invoice") for the purchase of all such products, which will, among other things, have the following information printed on it: Users are forbidden from using any of the products they buy through the Platform for business, advertising, resale, or further distribution. However, all purchases made on the Platform must be for personal use. Users who have registered businesses can buy products from merchants on the platform that meet their needs.

0 kommentar(er)

0 kommentar(er)